Reselling platforms such as Meesho spread e-commerce and draw investors

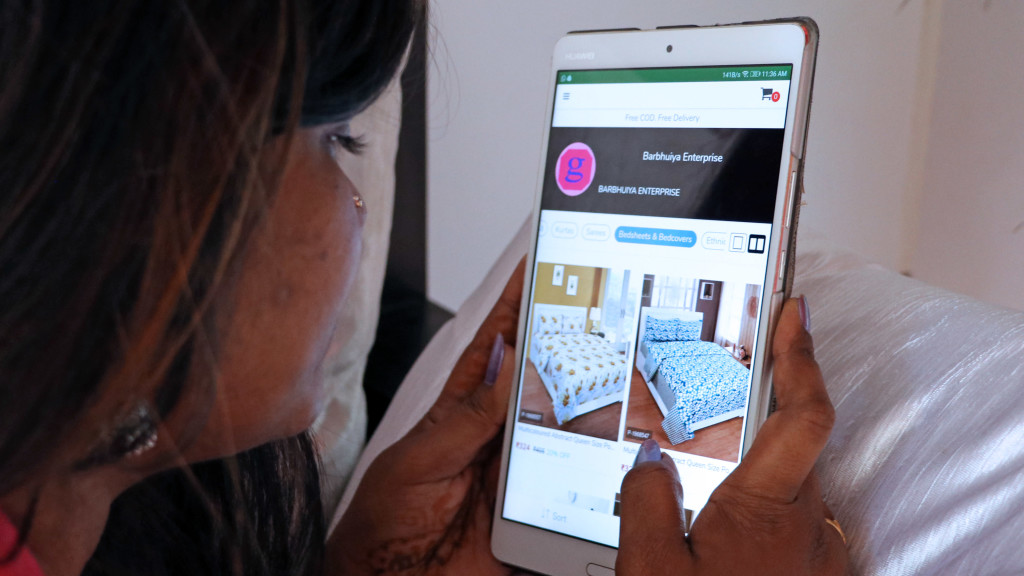

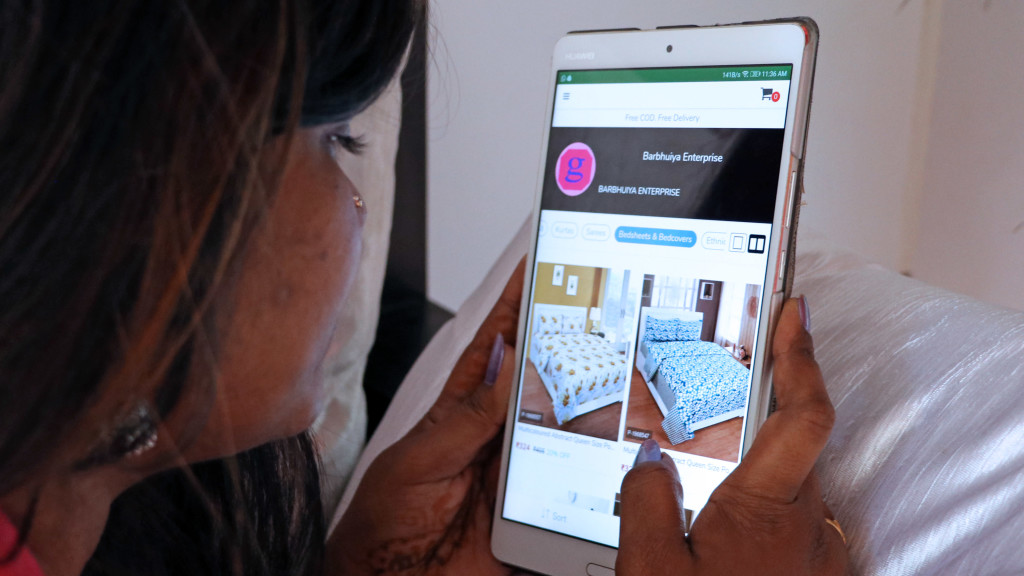

BANGALORE — Shravanti Chanda, a 31-year-old Hyderabad woman who quit her information technology job after she married, is one of many housewives across India earning money at the intersection of e-commerce and social networks.

Shravanti discovered Indian social commerce site Meesho a few months ago and now makes $150 a month reselling goods for a markup that she decides.

“By signing up as a reseller, I am able to coordinate with my network and earn money, all on my phone,” she said. Housewives make up the bulk of resellers on Meesho.

These startups target the huge user bases of social networks such as WhatsApp, Twitter and Instagram. As the internet reaches small towns and rural areas, the companies are building e-commerce opportunities by reaching out to these new digital citizens.

Globally, social commerce generated sales worth $50 billion last year through social networks alone. Technavio, a market research company, reported that the global social commerce market is expected to grow at a compound annual rate of 34% between 2017 and 2021.

Key categories include consumer health care, baby products, food and beverages, financial services, fashion and personal care items, according to a survey by Indian IT trade association Nasscom.

Wooplr boasts a nationwide network of 30,000 social sellers who speak over 20 languages and reach out to 10 million customers spread across 250 towns and cities.

Many Indian social commerce platforms have a similar business model. Kunal Sinha, a co-founder at GlowRoad, said the startup lists products supplied by manufacturers and wholesalers at their best price. Once the items appear on the platform, the resellers can choose what they want to sell and at what price.

“The resellers can mark up the prices to whatever level they want, as long as they are able to sell it,” Sinha said. “If an item is available for $7 on the platform and the reseller sells it at $10, they get to pocket [the difference], as we have already added our costs in that $7.”

Sinha started GlowRoad in June 2017. His wife had to leave the workforce for almost four years after having two children, and the couple realized that many Indian women faced a similar situation. The reseller network has raised about $2.8 million from Accel Partners, an investor in big e-commerce platforms like Walmart-owned Flipkart and Myntra.

The concept has helped resellers such as Bharti Joshi, a 45-year-old from the southern state of Karnataka who has been associated with Meesho for the past year.

Joshi gave up her job to care for her two children. She heard about Meesho from a friend, signed up as a reseller and now earns $150 to $200 per month. Her earnings reach $250 during festive seasons. She sells clothes, shoes, home decor and other items through the app on her phone by reaching out to friends and relatives.

EZMall also has a strong network of female resellers. Amit Bansal, the platform’s founder and CEO, said housewives are the core users through all channels.

E-wallet company PayPal has said that nearly 80% of merchants it surveyed in China, India, Hong Kong, Singapore, Thailand, the Philippines and Indonesia are selling through social media.

India is “exhibiting a greater ability in operating multiple social media platforms to reach out to potential buyers for commerce,” PayPal said in a report for the survey, “Beyond Networking: Social Commerce as a Driver of Digital Payments.”

Many social commerce companies are enjoying strong growth. Meesho has received $65.41 million in funding since it was founded in 2015, market analysis company Tracxn said. Wooplr has drawn $13.78 million since its founding, while Shop101 has received $5 million.

KPMG analyst Jyotbir Singh Khuman sees immense room for growth, as only 1 million of the world’s 150 million businesses are online. This number will reach at least 10 million by 2021, he said.

Rijul Jain, an analyst at Wooplr investor Astarc Ventures, said social commerce works beautifully because consumers buy from people they trust and who know their tastes.

Selling a product across varied demographics and regions requires a different approach, “and resellers fill this gap,” Rijul said. “For instance, resellers are able to communicate with buyers in the language that they are comfortable in.”

The PayPal report offered multiple reasons for the rising sales through social media. About 66% think this format helps reach a wider group of people, while 61% consider it easier to set up a business through social media and 48% expect to use their network of friends and relatives.

“In social commerce, the personalization happens at a decentralized level and saves the retailers investments in resources, time and money in digital marketing,” Rijul said.

Most social commerce platforms have developed app interfaces in vernacular languages, which Khuman regards as a key feature that helps these companies improve their visibility. Speakers of local languages will constitute almost 75% of India’s total internet users by 2021, more than two and a half times that of English, Deloitte said in a report published in May.

EZMall’s Bansal thinks most commerce solutions in India today are in English. His platform aims to reach vernacular users through videos and content in Hindi to acquaint resellers with their products. Content will be added in five more big regional languages — Tamil, Telugu, Kannada, Punjabi and Gujarati — over the next quarter.

Article Credit: Asia.Nikkei